This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

The Yield Curve’s Alarming Twist – Is a Recession Looming?

- July 20, 2023

- Phil Cannella

- Blog

- 0 Comments

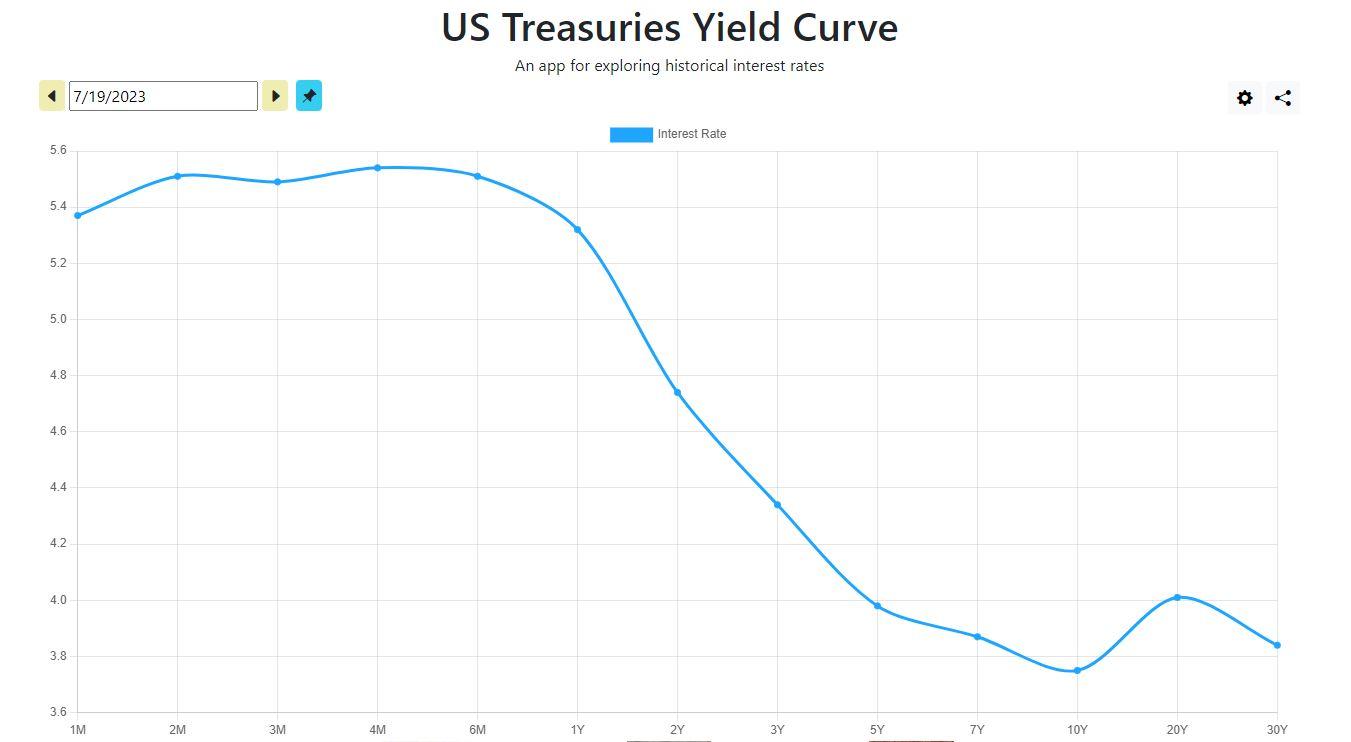

Economists use a range of metrics and data to determine the overall health of the economy. Some data sets, like Treasury bond yields, even have an uncanny ability to predict a recession. While stock market performance, inflation data, and interest rates can all be used as indicators of future economic turbulence, the shape of the Treasury bond yield curve has proven to be one of the most accurate predictors of coming recessions since World War II. When the Treasury bond yield curve becomes inverted, it is almost always a bad sign.

With the yield curve currently inverted in 2023, analysts are warning that a recession could be just months away. If you are in or near retirement, it is crucial that you pay attention to the yield curve and understand how it can predict trouble ahead for your investments so you can make the best financial decisions.

What is the Yield Curve?

The U.S. Treasury bond yield curve is a graph that plots the annual returns of Treasury bonds against the terms of those bonds, taking the shape of a curve. Under normal circumstances, this curve will move upward. To put it more simply, the longer the term of a bond, the higher its yield should be. A 10-year Treasury bond should have a higher yield than a 2-year bond.

There have, however, been multiple times throughout the past century in which the yield curve has sloped downward, meaning that short term Treasury bonds have a higher yield than long-term bonds. When this happens, the yield curve is said to be inverted and a recession is usually not far off. In fact, every recession since the 1940s has occurred about 6 to 24 months after a yield curve inversion.

Historical Yield Curve Inversions

Some of the most devastating economic downturns in history have been predicted by an inverted yield curve. Economists began to notice an inverted curve in February 2000; the U.S. economy officially went into a recession about 11 months later in March 2001. That recession lasted around 8 months.

The yield curve became inverted again in December 2005, after a year of interest rate hikes by the Federal Reserve. Less than 2 years later, in September 2008, the U.S. entered its worst recession since the Wall Street crash of 1929 that kicked off the Great Depression.

Another yield curve inversion occurred in August 2019, with the COVID-19 recession following about 7 months later. In each of these cases, retirement investors lost countless dollars from the value of their securities-based portfolios. These are just a few of the many examples of recessions that have been preceded by an inverted yield curve.

Does an Inverted Yield Curve Always Predict a Recession?

While it is a fact that every major recession over the last 80 years has been preceded by an inverted yield curve, it is not a guarantee that a recession is coming. It is, however, a sign that investor confidence is shaky. When investors are more interested in putting their money in short-term bonds, it generally means they are not confident in the health of the economy in the long term. This often coincides with stock sell offs that can tank the stock market. It can also be an indicator of economic troubles, even if a recession is not officially declared.

One example would be the most recent yield curve inversion, which happened in 2022. That year, the yield curve briefly inverted, first in April and again in July. These inversions came after two quarters of negative GDP growth, and although many analysts were reluctant to call it as such, this meets the strict definition of a recession. GDP figures for that time period have since been revised to show weak growth, but it still makes sense that investors would be concerned about the future of long-term Treasury bonds during that period of economic uncertainty.

Economists Predict Recession in 2024

In a recent survey conducted by Bankrate, experts have placed the odds of the U.S. economy falling into a recession by July 2024 at 59%. While a coming recession is far from certain, it is obvious that many of the same conditions exist today that have preceded historical recessions. Rampant inflation, rapidly rising interest rates, and an inverted yield curve are all good reasons for retirement investors to seek safety outside the securities industry.

The more than 5,000 retirees who have placed their trust in the exclusive Crash Proof Retirement System didn’t lose a penny of their principal during the recessions listed above, and they will be protected against any future recessions. The Crash Proof® Vehicles aren’t securities; they are based in the financial life insurance industry, which allows them to protect your principal during a stock market crash while crediting interest at rates similar to securities-based investments when the markets are up. With experts sounding the alarm that a recession could be just months away, now is the time to reexamine your retirement plan in Ambler, PA and in communities around the country.

Call 1-800-722-9728 to schedule your free financial checkup with the licensed retirement phase experts at Crash Proof Retirement, or head over to our events page and reserve your seat at our next screening of “The Baby Boomer Dilemma,” an important film featuring an army of the nation’s top financial experts who expose the cracks in the financial industry that have IRAs, 401(k)s, and other retirement plans on the brink of collapse, and provide solutions that align perfectly with our Proprietary Crash Proof Retirement System.

Leave a Reply

You must be logged in to post a comment.