This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

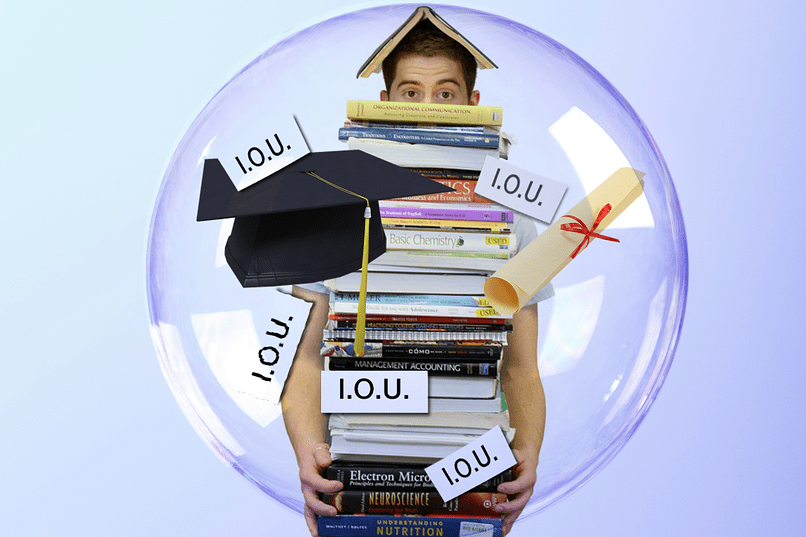

Student Loan Debt

In the world of economics and finance there are all kinds of “Bubbles;” there is the “global debt bubble”; There’s the “real-estate bubble”; & of course: “the stock market bubble”. One bubble that has not gotten as much attention of the aforementioned bubbles however, is the “student loan bubble.” The latest studies that show that student-loan defaults are rising at an alarming pace. A new analysis of government data by the Consumer Federation of America (which is an association of non-profit consumer organizations that was established in 1968 to advance the consumer interest through research, advocacy, and education,) found that the number of Americans in default on their student loans jumped by nearly 17% percent last year (2016). As of the end of last year, there were 4.2 million Federal Direct Loan borrowers in default, meaning they’ve not made a payment in more than 270 days. That’s up from 3.6 million at the end of 2015.

Experts at the Consumer Federation of America say:

“Despite all the improvements in the economy, student loan borrowers are still struggling- We thought in an improving labor market, default rates would improve but we simply are not seeing that.”

According to the U.S. Department of Education, at the end of 2016, 42 million Americans owed $1.3 trillion in federal student loans. This doesn’t include borrowing through private student loans, credit cards, and home equity loans to finance the growing costs of college. (With private loans it’s more like $1.4 trillion)

Mark Cuban, who is a very successful and well respected businessman, and is also the owner of the NBA’s Dallas Mavericks, told Inc. Magazine he believes the student loan bubble is going to burst! See video below.

Defaulting on a federal student loan can be a financial disaster for the borrower. Unlike other types of debts, most federal student loans cannot be discharged in bankruptcy. Those who go into default face serious consequences including: wage garnishment, damaged credit scores and added costs in fees, interest and legal fees. Student debt has risen along with the cost of education, which makes repayment difficult. The average amount owed per borrower rose to $30,650 in 2016, after rising steadily for years. In 2013, borrowers on average owed $26,300.

If you are in or near retired years and are worried about the next economic bubble bursting and blowing up your nest-egg, then you need to get educated on the exclusive Crash Proof Retirement System. There is a safe and guaranteed alternative to the risk, corruption and fees within the securities industry, and it’s called the proprietary Crash Proof Retirement System. If you’re worried about losing any part of your retirement nest-egg then let Phil Cannella and Joann Small educate you on the exclusive Crash Proof Retirement System. This proprietary system is designed so that when the market goes up, your accounts can experience gains, but when the market goes down or crashes, your accounts stay even; You never lose a penny of your principal and that’s guaranteed! Get educated on the proprietary Crash Proof Retirement System at the next Crash Proof event!

There is no cost…No obligation…Just a Crash Proof Education from the creator of the exclusive Crash Proof System-Phil Cannella, and the CEO of Crash Proof Retirement- Joann Small.

See what you’ll learn at a Crash Proof Retirement Educational Event. Watch below.

Leave a Reply

You must be logged in to post a comment.