This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

The Impact of Repealing the Glass-Steagall Act

- May 7, 2024

- Phil Cannella

- Blog

- 0 Comments

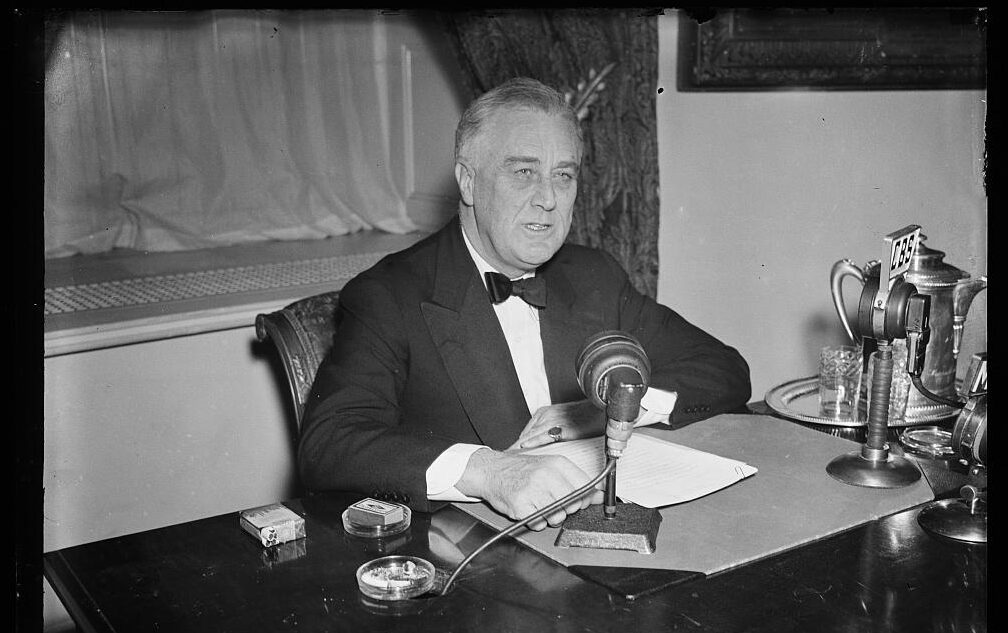

In the leadup to the “Black Tuesday” Stock Market Crash of 1929, and Banking Collapse of 1933, lax financial regulations created an economic environment where speculation with the everyday American’s money was rampant. Major banks gambled with their customers’ money, and when the bets those banks made proved to be ill-advised, the Great Depression began, and lasted for more than a decade. Between 1933 and 1938, President Franklin Delano Roosevelt (FDR) enacted a series of reforms, regulations, and public works projects known as the New Deal, which pulled the U.S. out of the Great Depression. One specific regulation within the New Deal aimed to prevent a repeat of Black Tuesday was known as the Glass-Steagall Act.

For 66 years, the Glass-Steagall Act pulled in the reins on the banking industry’s wild financial speculation and protected our economy from major market crashes like in 1929. Many economists credit Glass-Steagall with helping the U.S. economy steadily grow into a world power in the post-WWII era. When Glass-Steagall was mostly repealed in 1999, banks reverted to their old tricks, setting the stage for the two largest financial collapses in 2001 and 2008 since the Great Depression. Never before had our economy experienced two market crashes of that magnitude in such a short period of time. Today’s article will educate you on Glass-Steagall and the impact of its repeal.

What Was the Glass-Steagall Act?

Named for the bill’s sponsors – former Treasury Secretary and founder of the Federal Reserve System Senator Carter Glass and U.S. Representative and Chair of the House Banking and Currency Committee Henry Bascom Steagall – the Glass-Steagall Act separated commercial banking from investment banking. Prior to the passage of Glass-Steagall, banks were free to use their customers’ money to make speculative investments that exposed them to a great deal of risk.

“Some of our bankers have shown themselves [to be] either incompetent or dishonest in their handling of the people’s funds,” said FDR in the first of his famous Fireside Chats, in which he addressed the public through a national radio broadcast.

During the Stock Market Crash of 1929, many major banks started to collapse due to their participation in risky securities trading. More than 600 banks failed every year from 1921 to 1929. When their customers attempted to withdraw their money, those banks did not have enough cash on hand to meet their commitments to their customers. Thus, Glass-Stegall intended to limit commercial banks’ involvement in speculative investing so their customers could be certain their holdings remained liquid. The Act also created a regulatory framework for the financial industry as well as a safety net for bank customers.

Additionally, Glass-Steagall created both the Federal Open Market Committee (FOMC), which regularly meets to discuss monetary policy like benchmark interest rates, and the Federal Deposit Insurance Corporation (FDIC), which today insures customer bank accounts up to a limit of $250,000 per depositor. The Act also allowed the Federal Reserve to regulate retail banks, which, in conjunction with the creation of the Securities and Exchange Commission in 1934, provided meaningful oversight of the financial industry for the first time in our nation’s history.

Most importantly, Glass-Steagall forced banks to choose between commercial banking and investment banking. No institution operating as a commercial bank would be allowed to derive more than 10% of their income from securities trading. Over time, Congress imposed additional regulations on the financial industry to clarify certain aspects of Glass-Steagall and improve the effectiveness of the bill’s regulatory efforts.

The Repeal of Glass-Steagall

After decades of economic stability, the banking industry and their lobbyists began to push lawmakers to repeal Glass-Steagall, arguing that the bill stifled American economic growth. Critics insisted Glass-Steagall was unnecessarily strict, and that by diversifying their investment activities, commercial banks could engage in stock market speculation freely without putting their customers’ money at risk. But these arguments completely ignored the lessons of the past, because they were rooted in greed rather than a genuine concern for the economic well-being of the American public.

This movement to deregulate banks came to a decisive tipping point when the Financial Modernization Act of 1999 was introduced on the Senate floor, proposing a repeal of most of Glass-Steagall’s protection of investing Americans. Of course, not everyone in Washington was ready to trust the banking industry again. When the Financial Modernization Act of 1999’s repeal of Glass-Steagall was introduced many Senators voiced concern for the vulnerable state the bill would leave the American public.

Senator Byron Dorgan had this to say:

“I think we will in 10 years time look back and say we should not have done that.”

Senator Paul Wellstone echoed his concerns, saying:

“This legislation is an invitation to fraud and abuse.”

Despite these objections, the repeal effort led by Representative James A. Leach finally succeeded in removing many of the most crucial protections offered by Glass-Steagall. With President Bill Clinton’s signature, the Financial Modernization Act of 1999 was signed into law.

While the FDIC and FOMC would remain, banks could now take advantage of numerous loopholes that allowed them to go back to speculating with their customers’ money, and as in 1929, economic catastrophe struck. A series of recessions followed, beginning with the Dot-com Bubble of 2000 and the recession that came after September 11th, 2001. Shortly thereafter, a number of accounting scandals came to light, the most well-known being associated with Enron. These factors combined to cause the S&P 500 to lose 43% of its value between 2000 and 2002.

However, these recessions were nothing compared to the 2008 Financial Crisis, a banking collapse that would have been prevented if not for the gutting of Glass-Steagall. Without those critical regulations in place, commercial banks were free to gamble on securities. Banks invested heavily into the artificially-inflated real estate market after the repeal of Glass-Steagall, and when the mortgage-backed securities bubble collapsed in 2008, billions of dollars in American wealth disappeared in just a few months.

Crash Proof Retirement: Bringing Honesty Back to the Financial Industry

History has proven that the financial industry will do anything within and outside legal boundaries to line their pockets, with no regard for how their actions impact your financial future. Over the last century, large financial institutions and their lobbyists repeatedly took advantage of legal loopholes and lobbied extensively to repeal laws like Glass-Steagall leaving the American consumer vulnerable to all kinds of needless financial risk.

Crash Proof Retirement is reinstating the protections that Glass-Steagall offered to investing Americans. By recording every financial meeting with their current and prospective clients, and storing those recordings for a minimum of three years, Crash Proof Retirement guarantees a legally binding fiduciary responsibility to put your best interests first. Unlike the banking industry and the Wall Street advisors they are in cahoots with, every promise made by Crash Proof Retirement’s licensed representatives in a recorded financial meeting, like no market risk or fees, and the potential for double digit interest returns becomes legally binding and must be executed. Recording financial meetings serves as a testament to Crash Proof Retirement’s confidence in the financial education, custom tailored system, and financial peace of mind that they provide to over 5,000 clients. Would Wall Street financial advisors do the same? No, Wall Street firms would never allow their advisors to record their meetings because doing so would make their firms and advisors accountable for the bad financial advice they provide.

If you want to receive a different kind of financial education, one that is focused on your needs and your retirement security, get in touch with Crash Proof Retirement today. They provide a practical financial education free of charge, so you can have all the tools you need to plan for the future without worrying that a stock market crash or banking collapse will force you to delay or cancel your retirement. Call 1-800-722-9728 to schedule a financial checkup where we will review your retirement plan in Ambler, PA and nearby communities. This meeting is provided at no cost or obligation to you, and because the meeting is recorded, you can be certain that Crash Proof Retirement will stand by their word.

Leave a Reply

You must be logged in to post a comment.