This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

How Bernie Madoff Defrauded Investors and Outsmarted the SEC

- January 26, 2023

- Crash Proof Retirement

- Blog

- 0 Comments

The recent Netflix documentary series “Madoff: The Monster of Wall Street” outlines the life and various crimes of notorious Ponzi schemer Bernie Madoff. Throughout the series, a number of experts are interviewed, including former Securities and Exchange Commission (SEC) Inspector General H. David Kotz, who was in office at the time Madoff was arrested and prosecuted. While many viewers were hearing about this saga for the first time, the team at Crash Proof Retirement has been alerting people to the corruption and lack of regulation on Wall Street brought to light by the Madoff Case Since The Crash Proof Retirement Show began airing in 2008.

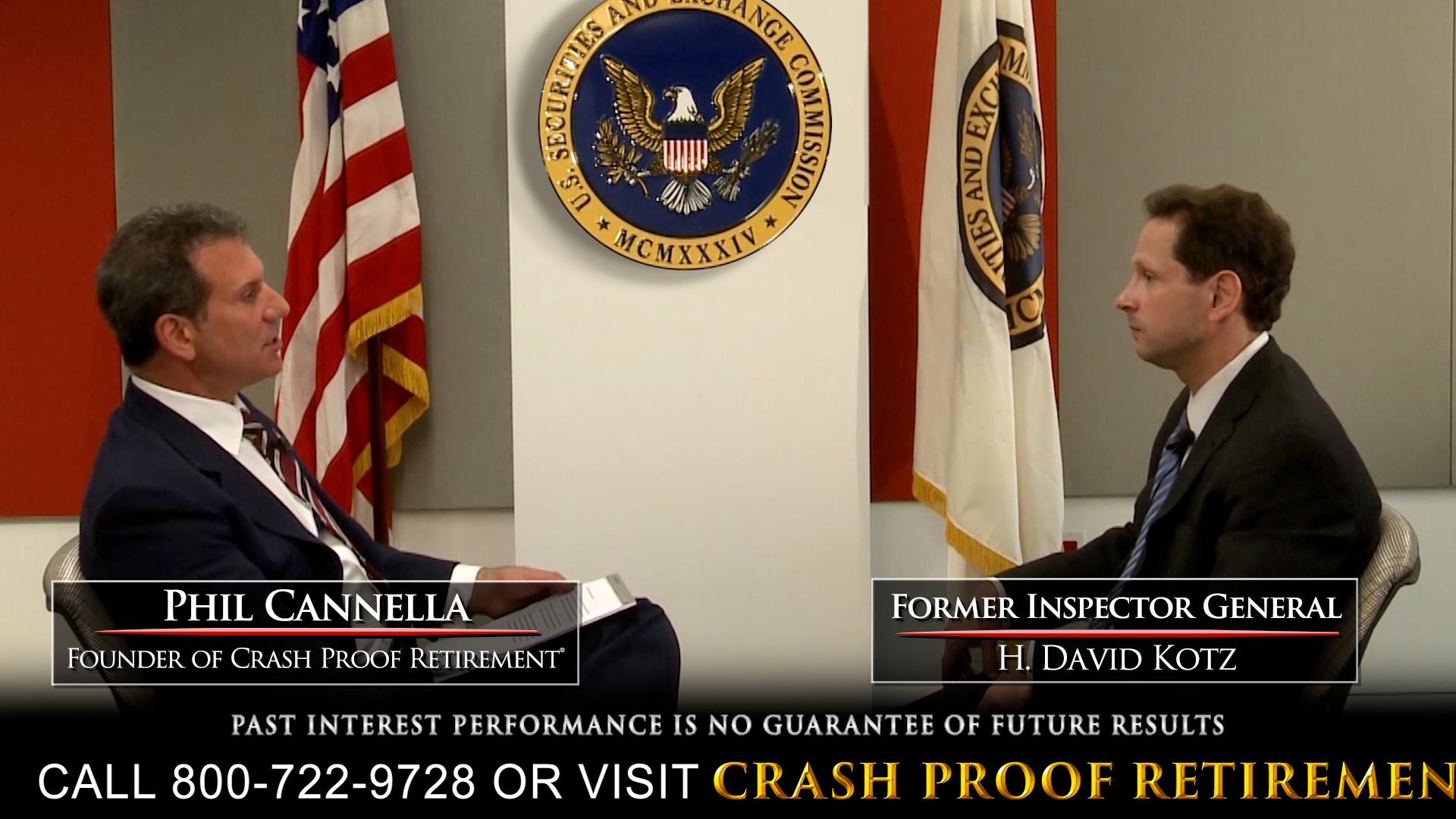

Crash Proof Retirement Founder Phil Cannella made history in 2011 when he became the first person to interview an Inspector General of The SEC who was still in office. During the interview, the two discussed a range of topics relating to the SEC’s efforts to regulate Wall Street and the difficulties inherent in preventing financial crimes. Read on to find out more about the issues that were revealed during the interview and how they led to the current state of the financial industry over a decade later.

Who Was Bernie Madoff?

Once a successful financier and Chairman of the NASDAQ stock exchange, Bernie Madoff became an infamous figure when his decades-long Ponzi scheme was revealed in 2008. Through his wealth management firm, Madoff operated an unregistered mutual fund that promised big gains for his clients with no risk. Essentially, he would take money from new investors and use it to pay the returns for his previous clients – all the while creating false documentation for trades he never actually made. At the same time, he used those funds to finance an opulent lifestyle for himself.

Although experts like financial analyst Harry Markopolis expressed concern as early as 1999 that the returns achieved by Madoff’s firm were not sustainable or even mathematically possible, the fraud continued until Madoff’s arrest in 2008. Prior to that, Madoff’s Ponzi scheme quickly began to unravel. His firm became unable to meet its financial obligations to investors, robbing them of billions of combined dollars, some of which were paid out as bonuses to Madoff and his employees. Madoff plead guilty to 11 felonies in 2009 and was sentenced to 150 years in prison. He died in 2021 of natural causes while serving his sentence.

David Kotz and the SEC Investigation into Bernie Madoff

In the Netflix documentary, H. David Kotz details the concerns the SEC had about Madoff’s investment firm. The firm’s brochure promised huge returns and 100% safe securities-based investments, a fact that SEC officials considered a red flag back in 1992, when they began an investigation into Madoff’s activities.

“You cannot have 100% safe trading investment; there’s no such thing as riskless trading,” says Kotz in the documentary.

Kotz is correct in saying there is no way to invest in the securities industry without risk. Investment vehicles like stocks, bonds, and mutual funds always carry some risk of the investor’s principal being lost during a stock market downturn. The fact that Madoff was promising otherwise should have been alarming to regulators in 1992, yet the fraud was allowed to continue for more than a decade after that. The SEC’s investigation was closed with “no wrongdoing” found on the part of Madoff and his associates.

David Kotz was appointed Inspector General of the SEC shortly before Madoff’s arrest, and as he revealed to Phil Cannella during their interview, he had immediate concerns about the effectiveness of his colleagues in regulating the financial industry.

“Bernie Madoff… was very effective in sort of playing the SEC folks in a variety of ways,” said Kotz in 2011, “I think part of what happened, they were simply not able to compete with the fraudsters.”

Kotz suggested that it may have been the inexperience of SEC investigators that allowed Madoff to slip through the cracks:

“He would not allow them to talk to anyone else in his office other than him. When they tried to talk to somebody else, he would usher them out the door. He would flatter them, give them some sort of information that they didn’t know and then, when they asked for documents that he didn’t want to provide, he would get very angry,” said Kotz, adding that the people working Madoff’s case were mostly junior examiners and junior investigators.

“I think in some ways they were overmatched, especially with Bernard Madoff.”

Are Your Investments Safe?

Although the SEC made significant changes after the Bernie Madoff case and Ponzi scheme prosecutions have gone up 50% since 2009, the task of regulating the financial industry continues to be fraught with difficulties. Many of the same regulatory issues that were uncovered by Phil Cannella’s interview with H. David Kotz still exist, with no solutions on the horizon. Financial crimes continue to be perpetrated on Wall Street, posing additional risk to anyone investing in securities-based vehicles like stocks, bonds, and mutual funds. If you are in or near retirement, that is a risk you can’t afford to take.

At Crash Proof Retirement, our goal is to educate consumers about safe investments that exist outside the securities industry. H. David Kotz was correct when he said that risk is an inherent part of securities trading, which is why the Crash Proof Retirement System utilizes financial vehicles based in the life insurance industry. Because these vehicles are not tied to stock market performance like the securities-based investments offered by Wall Street, they can credit interest comparable to securities without any risk of losing your principal during a stock market crash. If you want to find out more, talk to a licensed retirement educator at Crash Proof Retirement today. We can help you develop a safe retirement plan in Bucks County and in communities around the country; call 1-800-722-9728 right away to schedule for free financial checkup.

Leave a Reply

You must be logged in to post a comment.