In today’s society, a significant amount of retirees are finding themselves living at or below the poverty level. This phenomenon is largely due to several factors that have converged to create a perfect storm for retirees facing financial hardship. They are contending with rampant inflation, rising costs, market volatility, and empty financial promises from their advisors who don’t adequately prepare them for these situations.

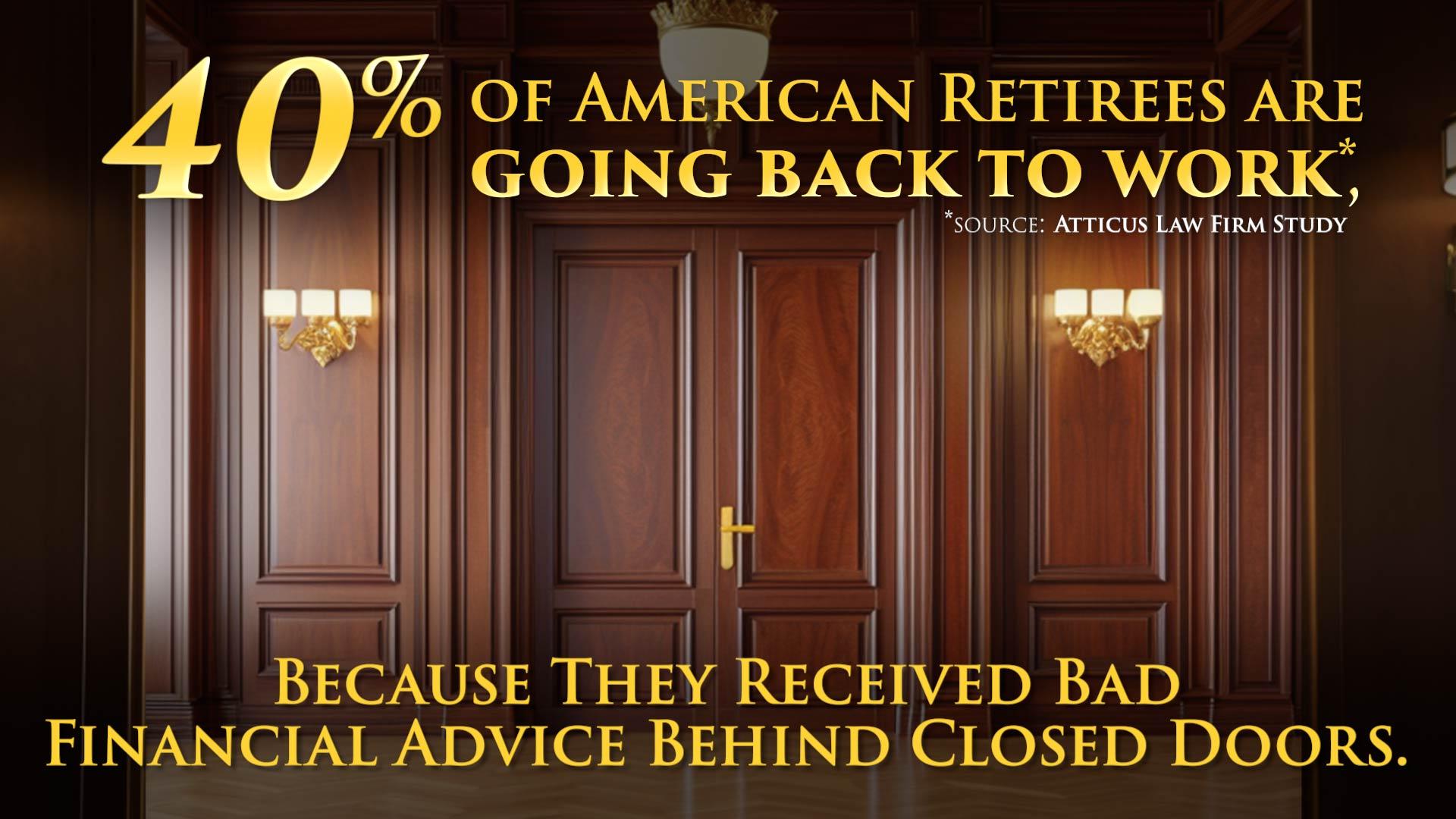

A new alarming study conducted by legal services firm Atticus shows that 1 in 5 seniors are currently working despite receiving Social Security benefits, and 40% of retirees plan on returning to the workforce in 2024, and one of the main reasons is receiving bad financial advice from their advisors or firms. Crash Proof Retirement has taken a bold step, becoming the first financial firm in history to record all consumer financial meetings. This makes every statement, all commitments and any guarantees legally binding between Crash Proof Retirement and the investing consumer. This approach has protected thousands of consumers from any misinformation disseminated through financial firms.

Social Security’s Weak 2024 Cost Of Living Adjustment (COLA)

Back in January, we questioned whether the modest 3.2% COLA for Social Security recipients would be enough to account for the extreme rise in consumer prices that began during the COVID-19 pandemic. Based on data from the consumer price index, we determined that a 3.2% increase in benefits – amounting to an average of $55 more dollars per month – was not nearly enough to cover the actual increase of inflation, totalling over $945 per month. The problem for those not earning a working paycheck. Compared to 2023’s 8.7% increase, the 2024 COLA does not accurately reflect the reality of living in retirement after years of high inflation.

Unlike working investors, retirees are no longer earning a working income – they’re on a non working fixed income, such as social security, and don’t have the time or ability to recover from market volatility or crashes. Investors who are still in the workforce have the rest of their working years to recover from market crashes that occur during their working career. Those in or near retirement don’t have that luxury. If a retiree exposes their retirement funds to market risk, they don’t have enough time to recover their losses.

The Atticus study sheds more light on difficulties faced by American retirees:

- 62% of seniors were not satisfied with the 3.2% COLA this year

- Almost 60% of seniors are already struggling financially

- Single seniors have been hit even harder; 70% of them are struggling financially

- 40% of retirees and 47% of single retirees plan to return to work this year

- Only 52% of seniors are confident in Social Security’s ability to provide for their long-term financial needs

The data collected in this study raises serious questions about financial professionals that you should be asking yourself:

- Why don’t retirees have enough income to afford them a full retirement?

- Why do so many of them have to go back to work after retiring?

- Why are they depending on Social Security as their primary or only source of retirement income?

- Why are so many retirees left unprepared for inflation and other unexpected expenses, despite the obvious prevalence of these issues?

In our opinion, the heart of these issues lies with the motivations of financial advisors who are not held to a full fiduciary responsibility when advising their clients.

Are Retirees Getting the Accurate Financial Advice?

In a perfect world, every financial advisor would always act in the best interest of their clients. In reality, Wall Street does not have a full fiduciary duty that legally binds them to represent their clients’ best interests. In fact according to Dalbar Incorporated, Wall Street is not operationally set up to handle a full fiduciary responsibility to the everyday investor. Professional firms like Crash Proof Retirement have a full fiduciary duty to ensure their clients always come out on top through legally binding financial recordings, even if it means they have to take a hit to their own income. If traditional financial advisors had nothing to hide and have a full fiduciary duty, why wouldn’t they record all of their financial meetings? Fortunately, Crash Proof Retirement is the only firm known to record all financial meetings. Wall Street advisors don’t fully educate their clients on safe financial vehicles that provide guaranteed income without market risk or fees. Instead, they recommend risk-based assets to their clients, regardless of their age, because those are the type of investments that help advisors fatten their wallets with up-front and ongoing fees. Wall Street advisors collect those fees even if their clients’ portfolios aren’t giving them the returns they were promised.

Risk-based assets include stocks, bonds, and mutual funds whose value fluctuates based on the performance of the economy which directly affects the stock market. When these risk-assets lose too much value, the client can be forced to delay their retirement, accept a lower standard of living, or go back into the workforce in their golden years. Wall Street advisors and traditional financial advisors can’t guarantee their clients solutions for challenges like long-term care, which is your greatest financial risk, as well as taxes, inflation, and market volatility.

In addition, advisors charge significant fees for their services, and those fees are taken directly from your retirement accounts even if they aren’t performing as expected. These hidden fees eat away at your nest egg, leaving you with inadequate income in retirement. Financial advisors are often not transparent about the fees they charge and what they cover. Many retirees are in for a surprise when they look at their account statements and realize how much of their hard-earned money is going to unnecessary and hidden advisor fees.

Crash Proof Retirement: A Legally Binding Financial Education You Can Trust

Crash Proof Retirement is so confident in the financial education provided by their licensed independent educators that they record and store every financial meeting with their clients. Most advisors would never allow recording in their offices, because they can’t guarantee that their clients will come out on top. That’s why Crash Proof Retirement is raising the standard of fiduciary responsibility across the financial landscape and changing the way Americans get educated about their finances. They are proud to record all financial meetings with their clients because of their proven track record of delivering a full fiduciary responsibility to over 5,000 clients. Crash Proof Retirement is putting their money where their mouth is, which is something your current financial advisor probably can’t say.

In a recorded financial meeting with Crash Proof Retirement, all promises made about our exclusive system by our licensed representatives, such as market-like returns credited as interest with no market risk or fees, and guaranteed income that won’t deplete your nest egg, are legally binding between our firm and you, the investing client. This unparalleled act of video and audio recording in all financial meetings sets Crash Proof Retirement apart from all other financial firms in its transparency and provides you with an unrivaled assurance that all declarations made by Crash Proof Retirement are concrete and will be executed.

Your retirement is supposed to be your opportunity to relax after a lifetime of hard work and reap the benefits of your investments. As recent data has shown, a large portion of retirees haven’t been able to achieve that goal because their financial planners are giving them bad advice. You don’t have to depend on Social Security to provide most or all of your retirement income; you can find a better way to save with Crash Proof Retirement! Crash Proof Retirement’s licensed independent retirement educators will be happy to give you more information about retirement planning in Conshohocken, PA and other communities across the country, so please don’t hesitate to get in touch by calling 1-800-722-9728. Your financial checkup will be provided free of charge and with no pressure to commit. Once you have received your retirement education, you will be empowered to make the right choices about your future so you won’t find yourself forced back into the job market because of inadequate retirement income.

In today’s article, we have discussed how the post-pandemic economic environment has proven to be a challenging one for America’s retirees. In subsequent posts, we will discuss how the Repeal of The Glass-Steagall Act in 1999 and the massive wave of retiring Baby Boomers is hurting the lifestyle of American retirees.