With the 2024 election looming in November, people in or near retirement all over the country are concerned about what the next presidential administration could mean for their retirement plans. No matter who wins the election, it will no doubt have a major effect on the economy, on inflation, on the tax code, and on many other aspects of life. While you may be feeling a great deal of uncertainty about the future, the team at Crash Proof Retirement® has some good news for you: you can election-proof your nest egg with the proprietary Crash Proof Retirement® System. Here are some of the ways in which you can feel secure no matter what the results of the next election may be:

Eliminate Market Volatility and Loss of Principal

It’s no secret that the results of an election can affect consumer confidence, and cause fluctuations in the stock market as a result. An analysis of stock market data going back to 1927 published by T. Rowe Price shows that S&P 500 returns were generally higher in the lead-up to an election, then fell sharply after. In addition, more than half of the 12-month periods following a presidential election coincided with a recession. In other words, stock market performance in the first year of any presidential administration is a coin toss. The T. Rowe Price report also found that market volatility increased during the 24 months surrounding a presidential election.

For those who are in or near retirement, stock market volatility or a recession could mean their retirement savings take a major hit, but only if they are dependent on securities-based financial vehicles like stocks, bonds, and mutual funds. Because the investments used in the Crash Proof Retirement® System are based in the financial life insurance industry, they are not subject to the same fluctuations as securities-based investments. Not only are Crash Proof® Vehicles guaranteed not to lose a penny of your principal during a stock market crash, they eliminate the peaks and valleys of stock market volatility to provide guaranteed growth that you can depend on.

The Crash Proof Retirement® System’s Built-in Inflation Fighters

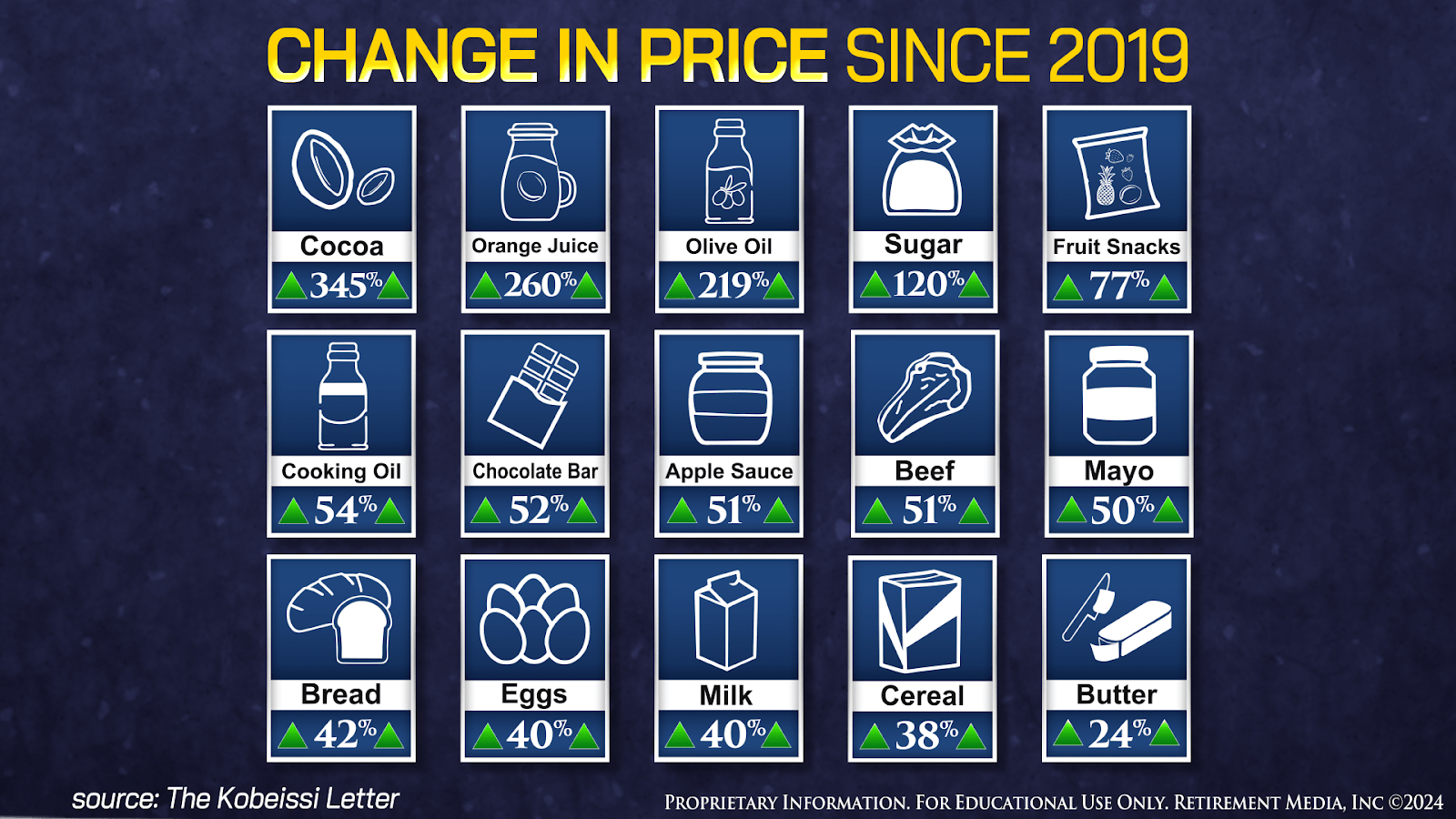

Inflation has been in the news ever since the COVID-19 pandemic, and although the rate of inflation has slowed in the past year, the actual costs of goods and services continue to rise. For those in retirement, this can mean they have a harder time affording the things they need to have a high quality of life.

If prices continue to rise after the 2024 election, the Crash Proof Retirement® System has a built-in solution to ensure you can make ends meet. Our proprietary Inflation Fighters allow you to withdraw from your System with no tax penalty. With Inflation Fighters on your side, you can combat rising costs and increase your income over 35% without depleting your nest egg.

Guaranteed Income for Retirees

Speaking of income, the Crash Proof Retirement® System truly guarantees it! While your Social Security income could be on the chopping block for the next presidential election, and Wall Street corporations can go under, taking the income you draw from their investments with them, Crash Proof Retirement® has safeguards that guarantee your income no matter what happens. Life insurance companies legally cannot go into bankruptcy, and rarely go out of business. Even if they do go out of business, they go into receivership, meaning that all the other companies in the industry come together and keep that company’s clients whole – a true safety net. That includes the income you get from your Crash Proof Retirement® System.

What this means for retirees is that they can continue to receive a consistent income, completely independent of Social Security and that can’t be influenced by anything that happens on Wall Street.

Tax Advantages

Both presidential candidates have proposed sweeping changes to the tax code, and depending on how much income you have, this could mean a significant increase in your tax liability. Even though we are not CPAs, the Crash Proof Retirement® System offers multiple solutions to help you fight higher taxes that your accountants and financial professionals may not even be aware of.

First, Crash Proof® Vehicles grow tax-deferred, so you don’t have to pay taxes on your nest egg until you withdraw it as income. Second, we help many of our clients take advantage of the benefits offered by the Roth IRA, which eliminates RMDs for you and your heirs, and allows you to have tax-free withdrawals in the future. If taxes go up in the next 4 years, you will be glad you converted your traditional IRA to a Roth! Finally, the vehicles used in the Crash Proof Retirement® System qualify for the exclusion ratio, a little-known IRS rule that allows you to have a 10-year guaranteed income that is 85% tax-free.

Credited Interest That Can’t Be Taken Away

We have already mentioned how the Crash Proof Retirement® System protects your principal from being lost during a market crash, but it also provides another benefit when the stock market is up. When your Crash Proof Retirement® System goes up, it can achieve double-digit growth comparable to securities-based investments. That interest is credited to your account, and once that interest is credited, it becomes part of your principal and will be protected as well! Compare that to a securities-based investment, like a mutual fund. With those types of investments, your gains exist only on paper until you realize them. When the stock market has a good year, your accounts may be up, but the next crash will be poised to send them plummeting; you could even lose the money you initially invested. You will never lose your principal nor the interest credited to your Crash Proof Retirement® System, and it’s a major reason why thousands of retirees are changing the way they invest.

Call Crash Proof Retirement® Today for Your Free Financial MRI

Although the outcome of the next presidential election is far from certain, you can give yourself some certainty about your retirement plan in Wayne PA when you embrace all the benefits of the Crash Proof Retirement® System. Our licensed independent Retirement Educators will be happy to tell you more about how the Crash Proof Retirement® System can protect and grow your nest egg while providing guaranteed income for the future, no matter who our next president may be. Call us today at 1-800-722-9728 to schedule your free Financial MRI that will help you identify the potential weaknesses in your current portfolio.