This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

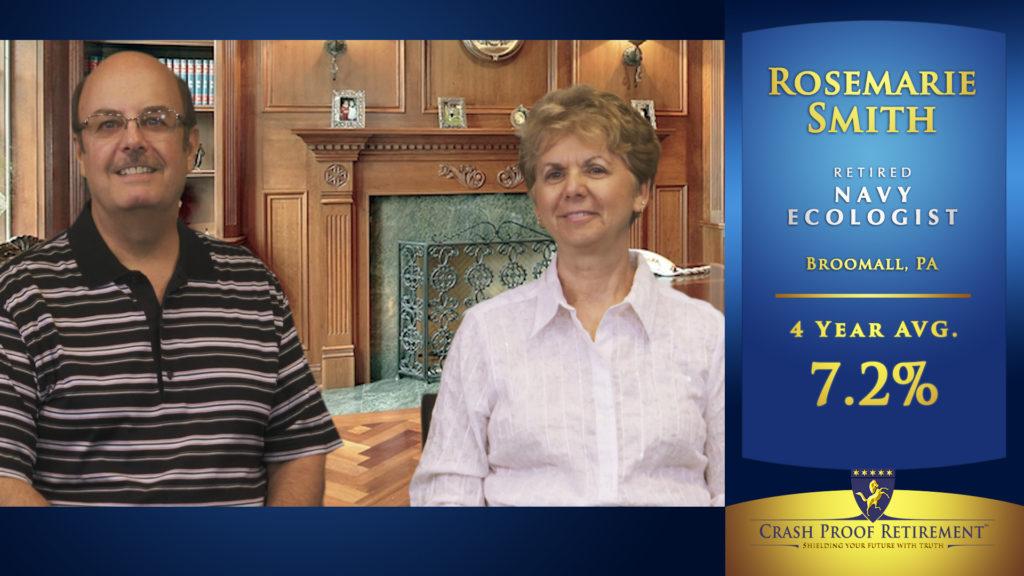

Crash Proof Retirement Spotlight: Robert and Rosemarie Smith

Crash Proof Retirement Consumers

The Crash Proof Retirement System, created by Phil Cannella, has helped thousands of people to secure their retirement futures. Today, we focus the Crash Proof Retirement Spotlight on Robert and Rosemarie Smith of Broomall, Pa.

Both Robert and Rosemarie are retired from the U.S. Navy, and one day Rosemary heard about Crash Proof Retirement on the radio. She was intrigued by the notion of never losing one penny of principal, and was interested in protecting the family’s retirement savings.

“My main retirement concern was preservation of principal,” she confirmed. “I chose to seek alternative investments. I had recently retired from the Navy—we had a [retirement] plan within the government, and I wanted to move it somewhere that was not the stock market, where it could’ve gone down.”

So Rosemarie convinced her husband to accompany her to a Crash Proof Retirement educational event, where the Smiths learned new information that made them both see the importance of protecting their futures. But one person wasn’t as excited about the information they’d learned.

“We had some resistance from our previous broker,” Rosemarie revealed. “He could not understand how this process that Phil and Joann have would work. He said that it was impossible that our money wasn’t in the market, and that we couldn’t lose. It got quite testy in his office.”

Rosemarie left her former advisor’s office convinced that she’d made the right decision. Upon coming over to Crash Proof Retirement, she knew she’d never go back to that old advisor. In fact, the consumer advocates at Crash Proof Retirement actually prevented Rosemary and Robert from signing anything until they were thoroughly educated and prepared.

“We had three meetings, because they really want you to understand what’s going on,” said Rosemarie. “After the first meeting, I was ready to go. I felt zero pressure. But they wouldn’t allow us [to sign] until we came back for the next two appointments. They really wanted us to understand.”

The Smiths have had a Crash Proof Retirement since 2011 and have averaged 7.2% in that time. They no longer worry about a market crash, a ‘con-man’ advisor or any other factors associated with risk investments. Instead, they enjoy their recess years, knowing that 100% of their money is working for them 100% of the time.

“When I see the market go down, I just snicker,” laughed Robert Smith. “Crash Proof Retirement means peace of mind to my wife and me.”

Robert and Rosemarie enjoy that peace of mind so much that they’ve referred three friends who’ve become Crash Proof—and two traveled all the way from Florida to protect their retirement accounts.

“I’d like to say thank you to Joann and Phil,” summarized Robert Smith. “I can sleep at night. I don’t have to watch the ticker and say ‘Oh my God, what’s happening this week?’ I just know that I’m safe. Thank you for my wife’s peace of mind and for helping me to sleep at night!”

Leave a Reply

You must be logged in to post a comment.