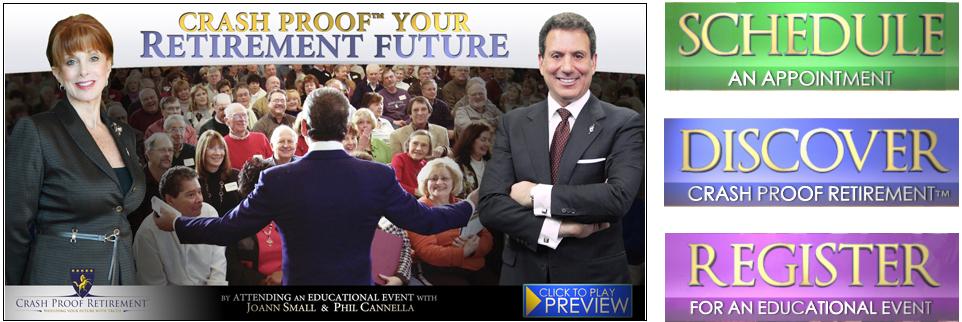

Conshohocken, PA Retirement Planning – Crash Proof Retirement™ is a new approach to retirement, designed to adapt to the many new challenges that face retirees today. It is a system that emphasizes preserving wealth, planning for longevity and a complete absence of market risk or ongoing investment fees. Conshohocken, PA Retirement Planning – The Crash Proof Retirement™ System was created by Phil Cannella in the wake of the recent market crashes that devastated retirement accounts across the country. It is now utilized by First Senior Financial Group, the firm he founded, which has protected over 400 million dollars in retirement assets over the past three years without a single client ever losing a penny to the risks and fees of Wall Street.

This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.