This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

Coronavirus Cools Off Investors – For the Moment

A positive turn for the market slightly reversed losses after the Dow Jones dropped nearly 500 points. Although the market remained relatively calm as the trial for President Trump’s impeachment began, the market started to slide as news of the Coronavirus spread fear...

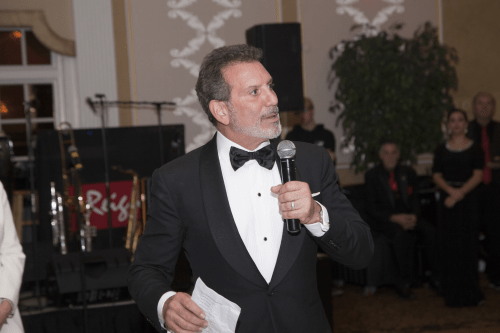

Read MoreCrash Proof Retirement Honors Clients with Appreciation Night

King of Prussia, PA — Crash Proof Retirement pulled out all the stops for their 11th Annual Client Appreciation Holiday Celebration which was held at Adelphia Restaurant on December 14th, 2019. Over 300 current Read More

Wall Street Slashes Thousands of Jobs: What Does it Mean for the Future?

While the stock market continues to reach record highs, Wall Street firms and banks around the world have been quietly shedding jobs. Over the summer, several well-known banks announced higher-than-average layoffs and that trend has continued into the end of 2019. In August, HSBC cut more than 4,7...

Read MoreManaging Liquidity with the Crash Proof Retirement System

The Exclusive Crash Proof Retirement System is comprised of little-known Crash Proof Retirement Vehicles that are interest bearing accounts. The great thing about this class of investments is that they’re safe, and free of fees, however many investors are unaware of t...

Read MoreCrash Proof Retirement Donates $2,000 to Vietnam Veterans of America at Charity Golf Tournament

King of Prussia, PA — For the fifth straight year, Phil Cannella, Joann Small, and the Crash Proof Retirement Team gave their support to the Vietnam Veterans of America (VVA) Chapter 1068 for their annual Read More

Crash Proof Retirement Donates $62,000 to National Liberty Museum

Phil Cannella, Joann Small, and Crash Proof Retirement COO Michael Stringer were on hand at the Philadelphia Downtown Marriott for the National Liberty Museum’s 20th Anniversary Glass Auction and Gala on Saturday September 14th to make a donation supporting the NLM and its Young Heroes Outreach Prog...

Read MoreChina Trade War Makes Stock Market Unpredictable in September

Investors all around the world are waiting with bated breath to see the outcome of the ongoing trade war between the United Stated and China, and whether or not you support tariffs on China, one thing is certain: tariff announcements and rumors of trade talks have made the stock market unpredictable...

Read MoreCPR to Sponsor National Liberty Museum Gala

[Photo: Crash Proof Retirement's donation is used at Universal Vare Charter School in Philadelphia as part of National Liberty Museum's Young Heroes Outreach Program.] King of Prussia, Pennsylvania -- As part of their ongoing efforts to support charitable causes in the ...

Read MoreThe September Effect’s Affect

The month of September is typically the worst month of the year for the stock market. Sure, the market is down already as we’ve seen during its recent 800-point drop. However, September is usually when the three leading indexes – Dow Jones, S&P 500 and Nasdaq all turn in the poorest performance...

Read MoreThis Week’s Radio Show: Financial MRI

Saturday, August 24, 2019 Hosts Phil Cannella and Joann Small talk about sub-account fees, a Financial MRI, Crash Proof Retirement System’s® logic and interview special guests. Their #1 goal is to increase your financial literacy and to help you Crash Proof your retirement with the proprietary Cr...

Read More