This website is strictly for educational purposes and is not intended to provide specific legal, financial, or tax advice. Phil Cannella and Joann Small are licensed professionals in the insurance industry. Crash Proof Retirement, LLC. does not recommend or sell securities to anyone at any time. Any interviews conducted by Retirement Media, Inc ®. published on this website are not to be considered endorsements. Crash Proof Retirement, Crash Proof Retirement Show, and Retirement Media, Inc. ®, and all related uses, are federally trademarked with the United States Patent and Trademark Office. Any company or individual found violating these federal trademarks will be vigorously pursued through all available legal avenues and penalized to the fullest extent of the law. © 2024 Crash Proof Retirement, All Rights Reserved.

This Week’s Radio Show: Newton’s Law

- November 29, 2022

- Phil Cannella

- Radio Show

- 0 Comments

In January 2022, Phil Cannella and Joann Small predicted that the stock market was going to crash and urged risk investors to protect their hard-earned retirement funds. In the months that followed, investors witnessed multiple bear markets throughout 2022 and heading into 2023, and those who refused to protect their funds, wound up losing trillions in the process.

Segment Summary

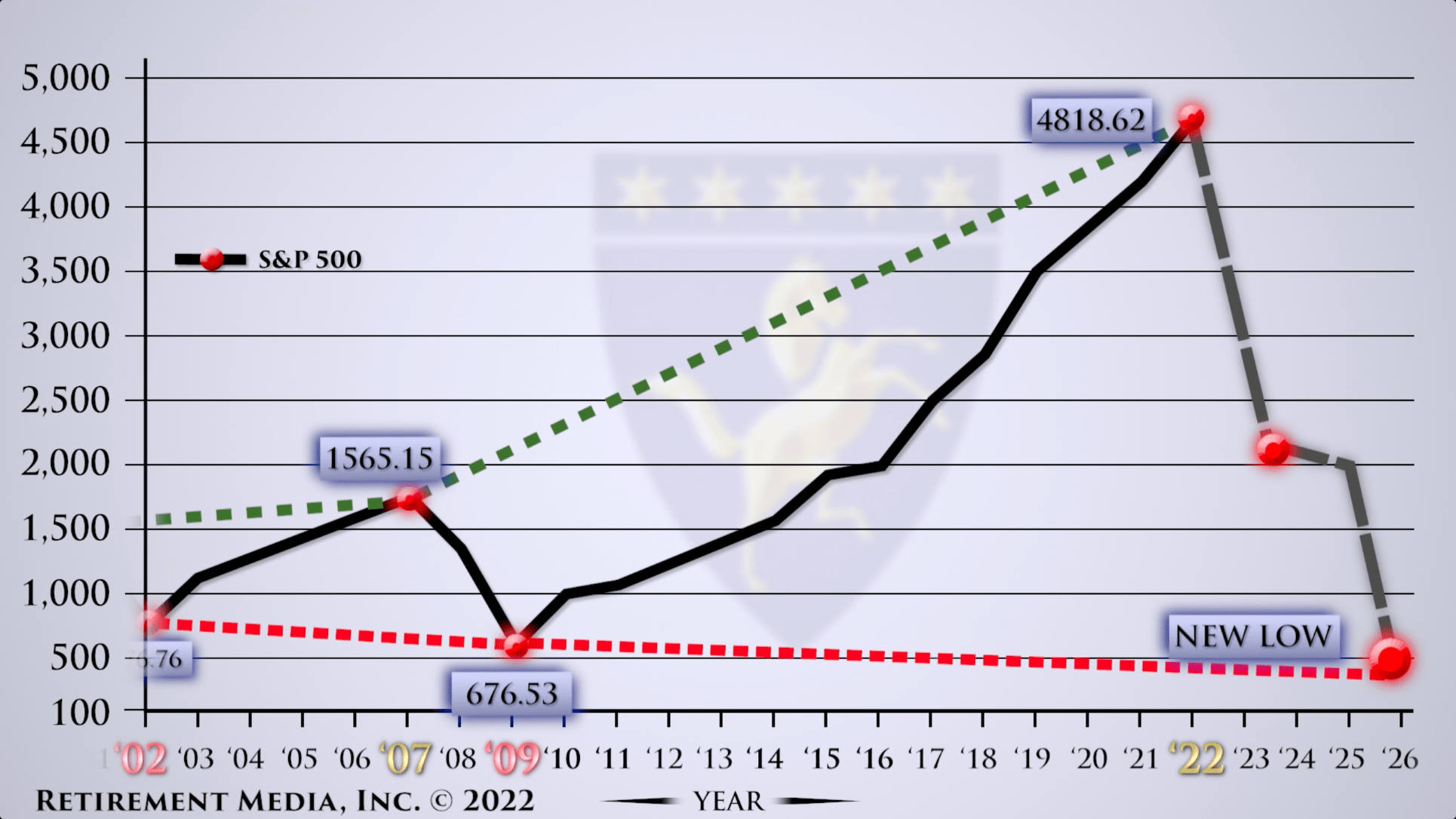

Throughout the segment, Phil and Joann refer to Newton’s Laws of Physics which they applied to the stock market to predict the crash of 2008 and the current trajectory of the S&P 500. Newton’s Law states that, for every action there is an equal and opposite reaction. When applied to the stock market, it means that when a new record high is recorded, it is always followed by the eventual establishment of a new record low.

To expand on their prediction, Phil and Joann spoke with famed economic forecaster, Harry Dent, who’s exceptional research validated Phil and Joann’s application of Newton’s Law to the stock market and confirmed their prediction that stock market activity heading into 2022 would be the beginning of a massive downturn.

While at-risk investors may never recover from Wall Street’s stock market crash, Francis Cardillo, a Crash Proof Consumer from Folsom, Pennsylvania explained that he feels confident with the Crash Proof Retirement System because he knows that it is impossible to lose. Schedule an appointment with one of our licensed independent educators by calling 800-722-9728 or by filling out the form on our contact page. Appointments are available in-person and through easy to use video conferencing.

Segment Transcription

Government Stimulus Impact on Markets

Phil: If your nest egg is invested in risk assets and you’re over the age of 50 that’s a red flag. You are floating towards one of the biggest global economic bubbles in the history of the country and Harry Dent will explain that coming up soon. Now currently, we have a Molotov cocktail being brewed by the Federal Reserve and this current administration in terms of interest rate hikes and tapering quantitative easing.

Now many people don’t understand what interest rate hikes does to Wall Street. Simply put, when interest rates go up, it makes debt across the board more expensive for everybody, including corporate debt. And this is what crashed has the market back in ’08 and ’09. Tapering quantitative easing, the stimulus program grounded in printing trillions of dollars of funny money that’s artificially inflated the economy and by default our stock market.

If you go back to the late ‘90s, right before the dot com bubble burst, the S&P [500] reached a record high before crashing in ’01 and ’02 and cut in half. The federal government came in with stimulus and synthetically inflated the markets from ’03 to ’07 and then the housing bubble burst and the S&P [500] fell below its previously low, another 50% [drop]. We call this Newton’s Law: for every market high there will be an established market low. If you remember Newton’s Law of Physics, for every action there will be an equal and opposite reaction.

Since 2009 the federal government has printed trillions of funny money dollars and inflated the economy, and now is reaching a tipping point and it’s about to burst. It’s known as a federal stimulus bubble, that has been blown up since ’08.

Joann: We recently spoke with world-renowned economic forecaster and NY Times Bestselling Author Harry Dent, who describes a pattern of market volatility that his research is showing which sparked a conversation about the prevalence of Newton’s Law.

Phil: Keep in mind, Harry Dent has predicted the late ‘80s fall of Japan. He also accurately depicted the late ‘90s boom in the United States as well as the dot com market crash of 2001. Now here is Harry’s prediction, but it starts out with my question on Newton’s Law.

Phil: If Newton’s Law comes true, higher highs will predict lower lows, does that mean the new market low is going to drop below the ’09 low of 672 points?

Harry: Absolutely! That is my forecast and there is [sic] two interesting patterns that describe exactly what you’re saying. It’s called the megaphone pattern: higher highs and lower lows, okay? The megaphone pattern projects the next crash will take us down to about 2000 on the S&P 500. You know, versus 4,800 recently. That’s a big drop! More than 50%, okay? The biggest first crash ever and then the broader one predicts it will go down to about 670 a couple of years from now. I love the megaphone pattern because it doesn’t happen much in history. It also happened in ’65, ’68, ’72. Those three tops came in a megaphone and kept hitting lower lows, exactly what you’re saying so these lower lows are coming soon by this pattern.

Phil: Now that is Harry Dent in an exclusive interview with Crash Proof Retirement on January 13th of 2022. Joann, we’ve been using our Newton’s Law chart for years, to show consumers patterns on the stock market and little did we know Dent’s research was analyzing the same chart to create what he calls the megaphone pattern, to describe the shape of the market and his projection for a major market crash. If you listen to what he said, he said it’s going to crash 50% initially and then over another couple of years it will go down another 40% or more making it the worst market crash in the history of our economy.

Joann: Cannella, great minds think alike. You’ve been saying this for years. But the point of the matter is that a correction of 20- to 30% would be financially debilitating for retirees, let alone an 80% market crash.

Being Prepared for Volatility

Phil: Remember what we say here, ladies and gentlemen, at Crash Proof Retirement. You don’t want to have to get ready when a market crash comes, you want to be ready. Be ready for the next market crash, that way if it never comes it didn’t make a difference. If it does come, boy, does it make a big difference that you were ready and didn’t participate in any market volatility in any year of your retirement. Market volatility in any year of your retirement is financially devastating, which makes it even more urgent to protect when we all see the storm approaching on the horizon.

Our Crash Proof Consumers overcame this challenge with principal protection. When the market does crash, you’re Crash Proof System doesn’t lose anything. It stays right where it’s at. Now that’s great, but the best part is how the Crash Proof Vehicles react when the market begins to recover. Since we never lost any financial increases, we don’t have to start at the bottom and come back up to where we were before the market crash. Because you don’t lose money in this system, you pick up right where you left off with no losses.

Joann: Now I want you to listen to Crash Proof Consumer Francis Cardillo of Folsom, Pennsylvania. Francis has been a consumer since 2015 and today, he has a specific message for listeners who are hesitant about getting off the market because of the fear of missing gout on possible market gains.

Francis Cardillo Testimonial

Francis: I know in life what goes up must come down, and the more things go up the bigger the low. The remarkable thing about Crash Proof is it’s impossible to lose. In the worst of down years where everybody else is going down 25%, I’m losing nothing — zero. I don’t feel I’ve missed out on the market gains since 2015, because in return I got security. Wall Street eventually will crash, it’s only a matter of time. So, I believe that the Crash Proof Retirement System is the best way to protect your assets.

Leave a Reply

You must be logged in to post a comment.