Customized Retirement Planning to Protect Your Savings From Losses

A customized retirement planning strategy that shields your savings, with no market risk and never any fees.

No Market

Risk

Never

Any Fees

Education-

First Approach

Personalized

Strategy

Customized Retirement Planning

Zero Market Risk

Unlike traditional investments, our system avoids the unpredictability of Wall Street entirely.

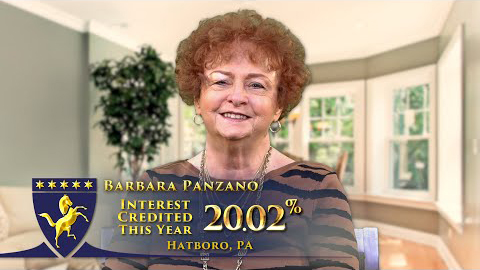

Reliable Growth

Crash Proof® vehicles offer steady market-like returns credited as interest that can never be taken away, ensuring your principal and earned interest are yours to keep, even during market downturns.

Guaranteed Income

Through our proprietary Crash Proof Income® cycle, receive a reliable, tax-favorable income stream tailored to sustain your retirement lifestyle, without depleting your nest egg.

Flexible Access & Customization

Access your funds when needed, and make changes to your Crash Proof Retirement® System when you want to.

Built on Advocacy, Not Wall Street

- We don’t sell market-based products

- No up-front or recurring management fees

- Based on Education, not a Sales Pitch

- Held to the highest form of a fiduciary responsibility

- Proven results for people in and near retirement

Crash Proof® Vehicles are not stock market investments, but safe, consumer-driven vehicles hand-selected by our financial analysts to get you through retirement.

Personalized Retirement Income Solutions

Our Crash Proof® Team of retirement income planning experts guide you through a 3-step educational process to explain the consumer-based solutions. During this process, our consumer advocates will empower you with all the knowledge you need to make the right decisions about your retirement future, and are always available to provide the services below:

1.

Financial MRI

Conducted by our salaried Crash Proof® Analysts, a Financial MRI examines your current portfolio to uncover hidden risks to your retirement future.

2.

Performance Reviews

All Crash Proof® Consumers can request a no-cost performance review to refine their customized retirement strategy.

3.

Customized Retirement Solutions

Every Crash Proof Retirement® System is uniquely designed to address your specific financial goals and concerns.

Too Good to Be True?

We understand your concerns. Many of our clients felt the same until they learned how our system works.

Real People. Real Results.

Attend a Crash Proof Retirement® Educational Event

Get educated, ask questions, and protect your future. Our events are free of charge, informative, and no pressure.

Ready to Protect Your

Retirement Savings?

Speak with a licensed retirement phase educator. Contact us today for answers with no obligations.

Phil Cannella

Founder of Crash Proof Retirement

Founded with Purpose

The exclusive Crash Proof Retirement® System is a one-of-a-kind customized retirement planning strategy created by Retirement Phase Expert the late Phil Cannella in the wake of the early 2000s market collapse. He witnessed firsthand how traditional Wall Street-based strategies were failing retirees and made it his mission to build a system that protects hard-earned savings from future financial disasters. Phil’s vision lives on through our dedicated team of Crash Proof® educators, analysts, and advocates, all committed to consumer advocacy and upholding the same principles he championed: truth, logic, and transparency. Learn more about our mission and latest retirement insights on our blog.

Crash Proof Retirement® in The Community

Crash Proof retirement® has always believed, you can make a living from what you earn, moreover you can make a life from what you give. To learn how Crash Proof Retirement® has woven threads of hope into the lives of those who need it most throughout the Philadelphia region for close to two decades, click the button below.